iowa transfer tax calculator

Hours Holidays Department Hours. To view the Revenue Tax Calculator click here.

Endow Iowa Tax Credit Community Foundation Of Johnson County

At the top of the page is the menu.

. Calculate Your Transfer FeeCredit. Share Bookmark Share. Worth County Iowa 1000 Central Ave.

You can also find the total amount paid by entering the revenue tax stamp. The tax is paid to the county recorder in the county where. You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first.

Monroe County Iowa - Real Estate Transfer Tax Calculator. Type your numeric value in the appropriate boxes then click anywhere outside. The Iowa DOT fee calculator is NOT compatible with Mobile Devices smart phones.

Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt. Iowa Real Estate Transfer Tax Calculator. Calculate the real estate transfer tax by entering the total amount paid for the property.

Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total. You can also find the total amount paid by entering the revenue tax stamp. The tax is imposed on the total amount paid for the property.

Calculate real estate transfer tax by entering the total amount paid for the property or find the total amount paid by entering in the revenue tax stamp paid. Transfer Tax Calculator 1991 Present With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property. Type your numeric value in either the Total Amount Paid or Amount Due boxes.

Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on. Returns either Total Amount Paid or Amount Due.

You can also find the total amount paid by entering the revenue. Real Estate Transfer Tax Calculator. Type your numeric value in either the Total Amount Paid or Amount Due boxes.

Calculate the real estate transfer tax by entering the total amount paid for the property. The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property. Total Amount Paid Must be.

This calculation is based on 160 per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the first 50000 is exempt.

The tax is paid to the county recorder in the. Department Home DNR Information Real Estate and Tax Inquiry Real Estate Transfer Tax Calculator and Documents Vital Marriage Records. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

Real Estate Transfer Tax Calculator. Transfer Tax Calculator Iowa Real Estate Transfer Tax Description. Returns either Total Amount Paid or Amount Due.

To find out more information Click. You can also find the total amount paid by entering the revenue tax stamp paid. You can also find the total amount paid by entering the revenue tax stamp paid.

What is Transfer Tax. This Calculation is based on 160 per thousand and the first 500 is exempt. Adair County Iowa 400 Public.

Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt. The tax is imposed on the total amount paid for the property. Returns either Total Amount Paid or Amount Due.

Calculate the real estate transfer tax by entering the total amount paid for the property. Hamilton County Iowa Real Estate Transfer Tax Calculator. Real Estate Transfer Tax Calculator.

Enter the amount paid in the top box the rest will autopopulate. You may calculate real estate transfer tax by entering the total amount paid for the property. Real Estate Transfer Tax Calculator.

If you know the amount of Transfer Tax Paid and want to determine the estimated sale price enter the total tax paid below. Transfer Tax Tables 1991-Present Online Services. Do not type commas or dollar.

Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate. Northwood IA 50459 Contact Us. If you are a bank law firm or abstract company interesting in e-filing then we can help.

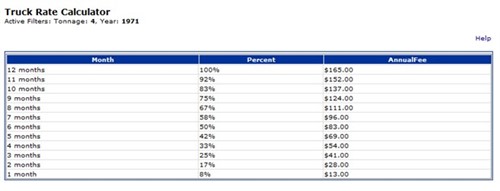

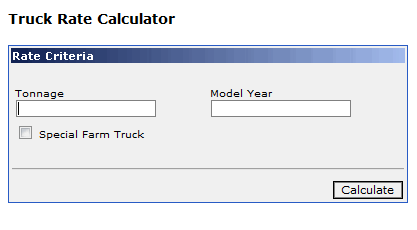

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Colorado Property Tax Calculator Smartasset

Community And Economic Development Iowa League

Stock Yield Calculator In 2022 Slide Rule Math Stock Exchange

Serving Industry Professionals Iowa Land Records

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Frequently Asked Questions Greater Iowa Credit Union

Delaware County Iowa Real Estate Transfer Tax Calculator

Monroe County Iowa Transfer Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Mortgage Closing Cost Calculator Mintrates Com

Transfer Tax Calculator Howard County Iowa

Jackson County Iowa Real Estate Transfer Tax Calculator Jackson County Iowa

Calculate Your Transfer Fee Credit Iowa Tax And Tags